Crypto Loans is a way to slip Crypto into circulation without selling it. There are several subtypes of this service: some regulated services allow to loan fiat leaving Bitcoin or any other coins as a deposit; some gives access to loan pools for decentralized loans; there are even unsecured loans offered by DeFi (decentralized finance) platforms.

Contents

What is Crypto Lending

Crypto Lending is peer-to-peer lending provided by other users who are willing to receive passive income as percentage rate. The system looks as a common bank system but with Crypto. The guarantee of returning Crypto Loan is fiat, stable coins or Crypto deposit depends on options provided by particular service.

Many investors follow HOLD strategy – holding assets for a long time, even several years for selling them in case of strong rate growth (“memory drive” for Crypto usually used). But it might happen that fiat money or other Crypto urgently needed, in that case investors have two variants- sell your assets losing the control of them or take advantage of Crypto Lending and unlock value of coins retaining ownership. That is the first advantage, there is one more not least one- Crypto Loan is more often used as hedging risks. That’s how it works:

- Supposing BTS value is 32 000$. An investor understands that it’s just retracement and in the nearest future strong growth is possible.

- An investor needs money urgently but he doesn’t want to sell such a promising asset.

- The person takes out a loan on Bitcoin bail and receives fiat money or stable coins. Let’s say, ee pledges 1 bitcoin getting in hold 32 000$.

- In a week BTS grew to 45 000$. If the investor had sold a coin, he would have lost 13 000$ of potential profit. However, he hadn’t sold it but pledged and could return these 32 000$ to receive his bitcoin back to thin client best Crypto wallet or another storage. But this bitcoin already costs 45 000$.

- Therefore, the investor gets the 13 000$ profit, despite having put Crypto of and took advantage of fiat or stable coins.

Particular opportunities and algorithms of actions depend on a platform’s type. Further, we will examine main types of service for Crypto loans companies.

Types of Credit Platforms

There are three main formats of Crypto Loan platforms:

| Centralized services | Maintain licensing the finance activities. As banks they can set percentage for loans and deposits, manage issue of funds. The loan might be immediate (automatic) or manual if extra investigation required. |

| P2p platforms | Loan offers and preferable interests are made and established by users themselves. It is free market where the platform itself acts as a comity which controls the participants fairness and storages pledged collateral |

| DeFi Crediting | Loans and deposits both are managed with the program – smart-contract. The platform role is in smart-contract support and convenient costumer interface delivery. Rate of interest is regulated itself depending on demand and supply for certain coins. |

All services are united by one alikeness- they are not interested in user’s credit history or work place or any other aspects. If a borrower bails, it proves their paying capacity automatically. That’s why Crypto Loan is a way out for those who can’t obtain credit for any reason in a bank.

Brief review of popular services

Inviting to evaluate the possibility of several in-demand Crypto Loan platforms referring to different categories. Before starting the review, we need to identify a term -LTV as it will be often used. LTV stands for Loan-to Value and means loan/collateral correlation.

For instance, LTV 60% means that the user cannot get more than 60% from the amount of bail. If provided bail is 1000$ then the max amount of obtaining funds is 600$. Talking about Crypto Loans, LTV is usually is between 50%-80%.

Binance Loans

The platform of the leading Cryptocurrency Exchange-Binance. About two dozen crypto and token might be borrowed with a bail of 15 coins. Crypto loan binance period is from 7 to 180 days, no fines with anticipated repayment. Start-up LTV is 65%. Interest rate is dynamic as its influenced by term of a loan. After getting an account on Binance, it’s allowed to use the service without verification. The interest is charged every hour. First, the interest should be repaid and then the primary loan. Arrears are possible to 168 days, during those the interest rate is charged in triplicate. If the arrears are not paid off in a timely fashion, Binance sells the collateral to settle.

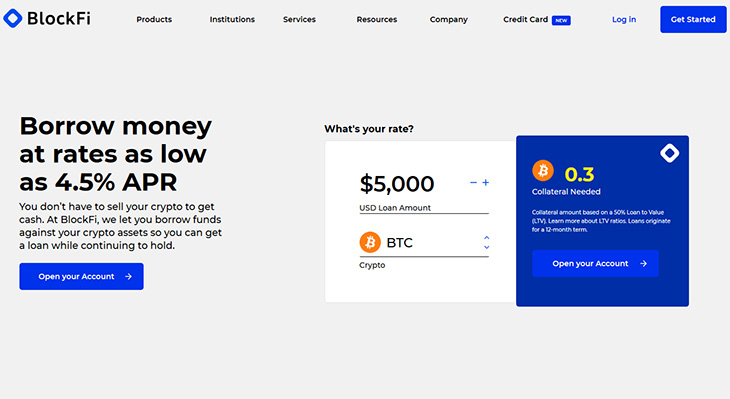

BlockFi

Regulated centralized platform for crypto secured loan. It allows to borrow dollars putting down Bitcoin, Etherum, Litecoin or token PAXG security deposit. Interest rate starts with 4,5%, starting LTV is 50%. The main disadvantage of this platform is obligatory verification with KYC.

Mind crypto wallet commission (including top hot crypto wallet) when sending in the deposit. Funds come to fiat account during 90 minutes. Bear in mind that the service sets quite big minimal loan sum- starts with 5000$, there is no maximum for outstanding loan.

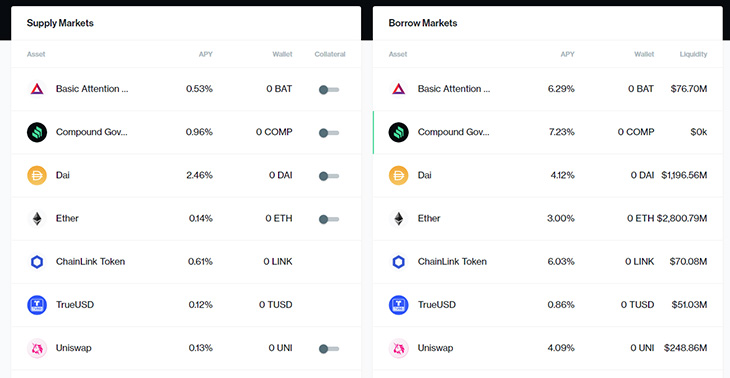

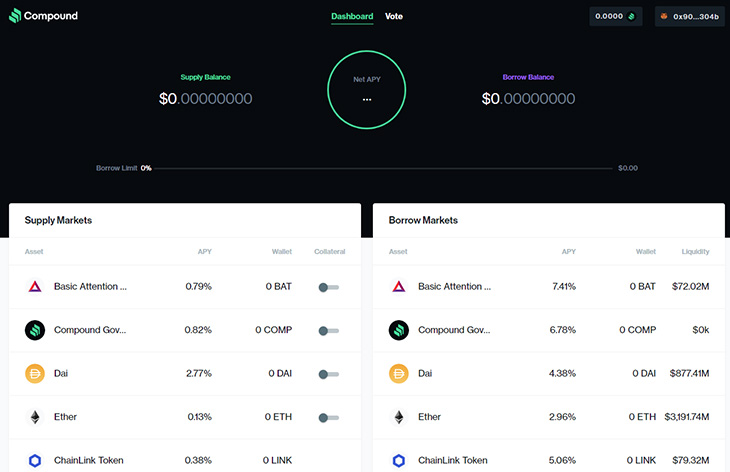

Compound Finance

Decentralized service to work with connection with web3-wallet needed. The most convenient crypto wallet security is Metamask. The platform works on Ethereum blockchain, based on smart-contracts, which are in charge with interest rate transaction and its corrections. Rates are changed with every new Ethereum blockchain.

Essentially, there are loan pools for every held token. Users put their assets into a pool and getting interest income. To other users the secured loan is interest-bearing; out of their overpayment creditors income and the platform’s income is financed. Interest rate depends on the balance of supply and demand.

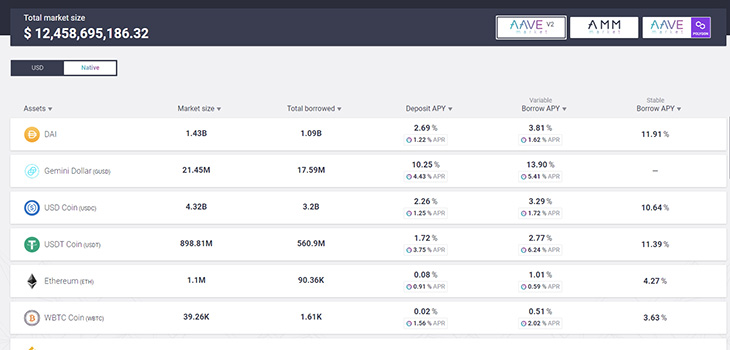

Aave

This loan protocol works similar to Compound, on the basis of loan pools. The service used to be known as EthLend and used p2p-loans, however later held a rebranding and moved to loan pools strategies. Besides already mentioned mechanism of secured loans, Aave also provides an interesting function- crypto loans without collateral.

They are called crypto flash loans. The point is that the user can have Crypto loan no collateral, however matured loan repayment should be done in a single transaction. Borrowing the unlimited number of means is possible if the bail is overpaid to the end of transaction.

Such method is used by arbitration for limiting trade risks.

Dharma

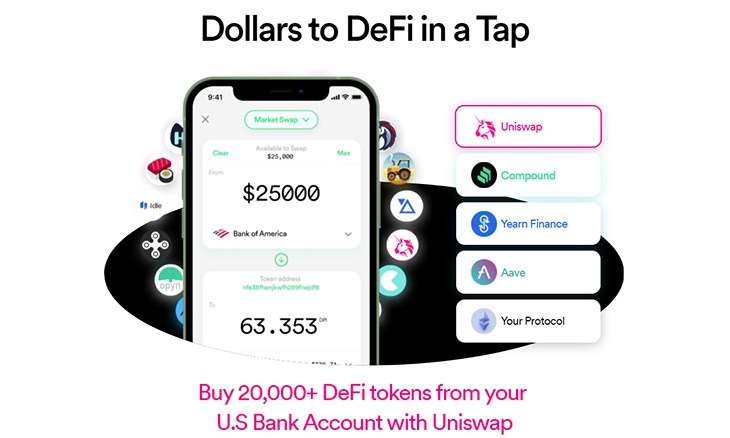

This platform might be called “hybrid”. Precisely, it’s a “bridge” connected fiat bank accounts with DeFi. Dharma has no their own loan protocol; it aggregates date from other DeFi platforms including Compound. Users interface is not complicated- alike mobile application, so its easily understood by newcomers.

The project also provides its own non-custodial wallet for assets keeping. It’s easy to make money on unused crypto on the app by lending it at interest.

Summarizing

Crypto loan theme is one of the most important topics for today in the cyber assets sphere, equally demanded as withdrawing money out of top cold crypto wallets or what trading stock to choose. Loans secured against crypto help get an easy access to fiat or stable coins, without selling own coins, provide an opportunity to make money in case of appreciation of currency, play an important role in hedging risks on volatile and unsteady crypto market. The choice of centralized or decentralized service depends on the user’s requirements.