Crypto wallets are the basic tool for managing funds in blockchain sphere. Crypto wallets are the main tool for managing funds in blockchain space. In addition to storing the keys responsible for accessing the account balance and signing transactions, these services can provide other options. For example, a crypto collar with a card makes it possible to buy coins with the help of a bank card, to withdraw instant convertible assets at current exchange rates and even pay in regular shops.

Now let’s talk about the best crypto wallets 2021, providing safe and convenient cryptocurrency storage. Thus, crypto wallet list is the following:

How cryptocurrency wallet works

Software Crypto wallets are the applications which can be run and used on a smartphone or a PC. There are also best cold crypto wallets in the form of physical devices. The first wallet was introduced in 2009 almost at the same time with the invention of Bitcoin. Today, the number of cryptocurrencies runs into thousands and each one has its own way of storing. When a user buys coins on the stock market or via the cryptocurrency exchange, he or she can send it to a unique cryptographic address, generated by a wallet.

The main difference between crypto wallets and the usual ones is that it is not the coins themselves that are stored, but a combination of encrypted keys and transaction history. Balance is formed according to the principle “the amount of incoming transactions minus the amount of outcoming transactions”.

Top crypto wallets in India

All the variants can be divided into software and hardware crypto wallets. The first ones run as applications (or web-sites) and refer to hot crypto wallet for iphone. It means that while working they always connect to the internet. On the one hand, it is convenient as it makes it possible to manage funds quickly and conveniently. On the other hand, it could be dangerous in terms of hacking.

Hardware crypto wallets in India store the keys in a “cold” way — without access to the Internet. Hardware wallets store keys in a «cold» way — without access to the Internet. To make a transaction, one must connect the device to a PC or phone and connect to the software wallet. The best cold crypto wallet is the one that allows setting a PIN code for accessing funds compatible with popular software solutions, equipped with a protected chip to protect against complex attacks.

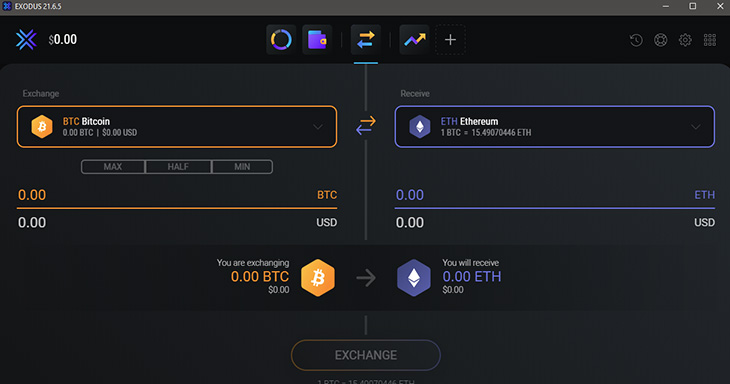

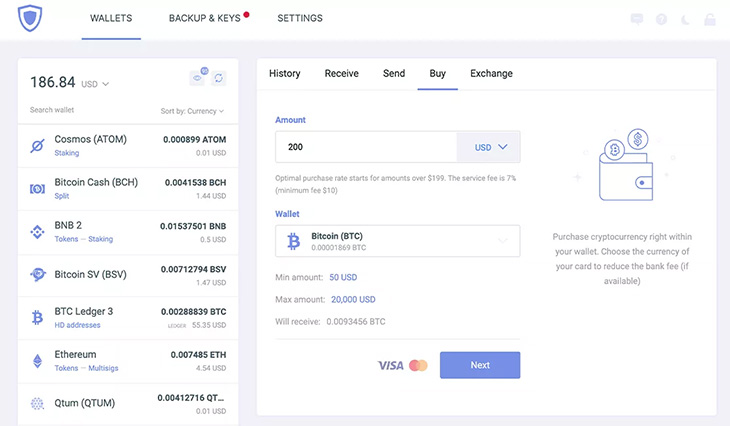

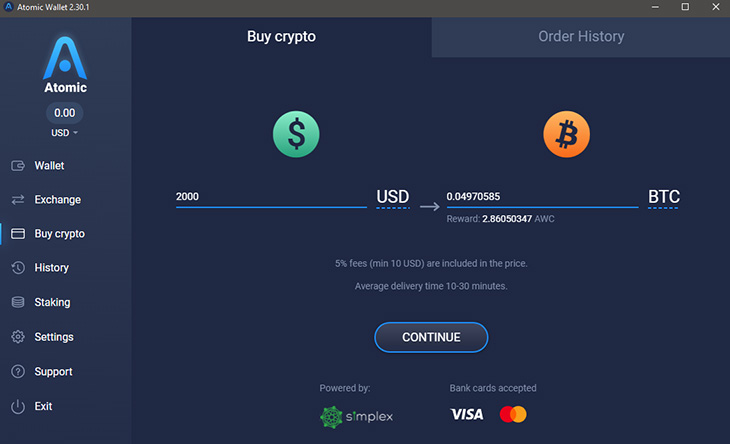

Bankcard support wallets

A card-enabled crypto wallet is an application that has entered into a partnership with a payment provider (such as Simplex) or an exchanger to enable users to convert their cryptocurrency into a fiat (rubles, dollars) and put it on a debit card.

Some examples of these websites and programs:

- Matbea is the platform combining both a wallet and an exchanger. It allows the exchange of such coins as BTC, ETH, USDT, LTC, DASH, ZEC, BNB, XMR, DOGE and so on into fiat (more than 20 currencies in total). It is possible to withdraw money almost into any ruble bank card, including Sberbank, Promsvazbank, Russky Standard, Avavgard, Tinkoff and as well as wallets UMoney, Kiwi.

- Trustee Wallet is the crypto wallet, available for iOS and Android. It supports withdrawal into bank cards in terms of rubles, dollars, hryvnas, tenge, euro and accounts of such payment systems as UMoney, Kiwi, AdvCash and Capitalist. Some tools, provided by different exchangers and stock markets are used for this purpose, for example, 365cash, CoinChanger, Kuna.

- The payment system Payeer is a reliable crypto wallet and also a multifunctional system for storing and currency exchange. There is even a crytocurrency stock market in this platform. It supports BTC, USDT, ETH, XRP, BCH, DASH and fiat currencies RUB, USD, EUR. It is possible to instantly exchange a cryptocurrency for a Fiat between private accounts and transfer to a bank card Visa/Mastercard.

There are just a few wallets of this type because there are some serious contradictions between crypto sphere and traditional finance. However, all the current trends show that, over time, crypto currency exchange for traditional assets will become more intuitive, simpler and faster in.

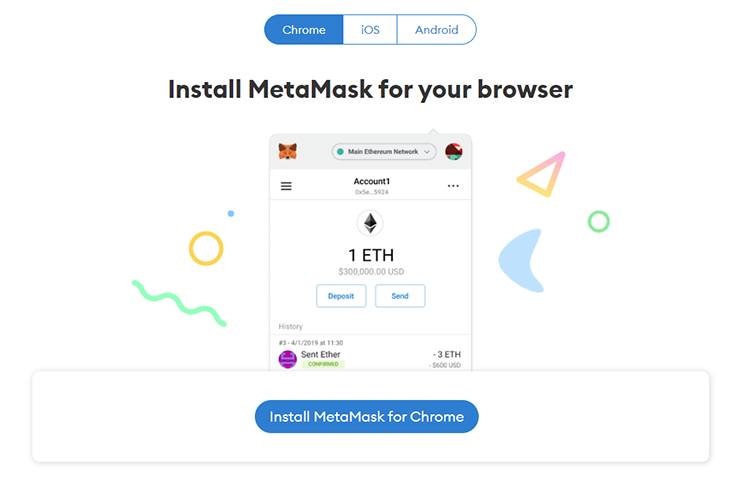

Services to work from browser

An online crypto wallet is a system that does not require downloading or installing an application, but can be authorized and run through any browser. Such platforms can be custodian or non-custodian, that is, either store user keys on their servers or save them on the side of users themselves. The second option is preferable — it is always better to control your own funds.

Examples of browser wallets for cryptoassets:

- This repository is available both through the site and as a mobile application. One can store hundreds of different coins, stablecoins, DeFi tokens, earn passive income on staking.

Verification is not necessary, so work is done anonymously. Among the additional services are the purchase of a crypt from a card, an internal exchanger, crypto loan no collateral and much more.

- com. One of the oldest and most famous services of its kind. It allows users to login and password, and one can additionally protect his or her account by including two-factor authentication. It supports several major cryptocurrencies, including bank card output (although the latter is only available to authenticated identity users).

- This option differs from the mentioned above because it is set as a browser extension. Using Metamask, the user can make transactions in a couple of clicks, and (and this is the main reason for his popularity) interact with decentralized finance applications — use DEX exchange markets, earn on profitable farming in liquidity pools, etc.

Online crypto wallets are user-friendly, not device-specific (except browser extensions), but care should be taken about who has access to the authorization data. It is desirable to activate 2FA, this will make it difficult for fraudsters to hack the account.

How expensive it is to work with wallets

While software versions of wallets are almost always free, hardware will have to be purchased. The price is between 7,000 and 15,000 rubles on average. But this option is the most reliable, so long-term investors are not deterred by the cost.

The standard structure of the crypto wallet commission is as follows:

| Cryptocurrency replenishment | Only the network commission is charged. |

| Cryptocurrency transaction | Only the network commission is charged. Less often the service charges its commission (in a change of 1%). |

| Card replenishment | The commission fee is determined both by the service itself and by the payment provider. May be from 5 to 10%. |

| Withdrawal to a card | Also between 5 and 10%. |

The high fees for operations with fiat are due to the complexity and cost of this action for payment providers.

Conclusion

The issue of the storage of crypto-assets is the first thing that should be taken care of in this sphere. Placing on stock accounts is only possible for a short period of time, keeping funds there constantly is dangerous due to potential hacking attacks.

The choice of a reliable, convenient and advantageous wallet will make life easier and allow users to keep the assets intact for an unlimited amount of time. However, care must be taken not to lose the keys and phrases of reset and to prevent third parties from having access to them.